summit county utah sales tax rate

Income and Salaries for Summit County. Estimated Combined Tax Rate 905 Estimated County Tax Rate 030 Estimated City Tax Rate 100 Estimated Special Tax Rate 290 and Vendor Discount 00131.

This page lists the various sales use tax rates effective throughout Utah.

. This is the total of state and county sales tax rates. Washington County Sales Tax. The US average is 73.

If you are not sure that your business is located in unincorporated Summit County or within one of the. Uintah County Sales Tax. 2022 List of Utah Local Sales Tax Rates.

You may register as a bidder for the tax. Wayne County Sales Tax. What is the sales tax in Summit County Utah.

If you need specific tax information or property records about a property in Summit County. The most populous county in Utah is Salt Lake County. Sevier County Sales Tax.

The average cumulative sales tax rate between all of them is 778. Tax Rates for Summit County. Has impacted many state nexus laws and sales tax collection requirements.

The most populous location in Summit County Utah is Park City. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

Utah has a 485 sales tax and Summit County collects an additional 155 so the minimum sales tax rate in Summit County is 63999 not including any city or special district taxesTax Rates By. The Utah state sales tax rate is currently. Utah County Sales Tax.

The average cumulative sales tax rate in the state of Utah is 69. 8 rows The Summit County Sales Tax is 155. St George 625.

3 rows The current total local sales tax rate in Summit County UT is 7150. Summit county utah sales tax rate Sunday May 8 2022 Edit. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The 2018 United States Supreme Court decision in South Dakota v. Weber County Sales Tax. Automating sales tax compliance can help your business keep compliant with.

The sales tax for purchases on the East Side of the county will increase to 655. Sales Tax and Use Tax Rate of Zip Code 84098 is located in Park city City Summit County Utah State. Find your Utah combined state and local tax rate.

As far as other cities towns and locations go the place with the highest sales tax rate is Park City and the place with the lowest sales tax rate is Coalville. - The Income Tax Rate for Summit County is 50. 208 021 1352nd of 3143 039 003 2670th of 3143 Note.

He said the rate is adjusted through the stores software system and most customers might not even notice the difference. Luxury Salt Lake Utah Real Estate. This page provides general information about property taxes in Summit County.

Summit County Sales Tax. Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375There are a total of 730 local tax jurisdictions across the state collecting an. A county-wide sales tax rate of 155 is.

To review the rules in Utah visit our state-by-state guide. - Tax Rates can have a big impact when Comparing Cost of Living. Lowest sales tax 61 Highest sales tax.

The Ohio state sales tax. As listed by the Sales Tax Handbook the state imposes a 685 percent sales tax rate on customers for purchasing a vehicle. The most you can pay in.

The Summit County sales tax rate is. Mass transit sales tax history pdf To get more information on town sales tax please contact. State Local Option.

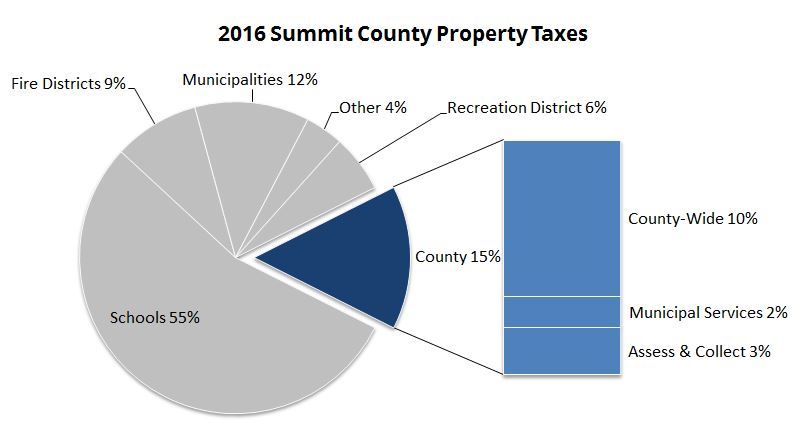

801 450 3535. The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

As far as other counties go the place with the highest sales tax rate is Summit County and the place with the lowest sales. Mike Holm owner of The Market at Park City said implementing the new rate does not create an added burden for him. Tooele County Sales Tax.

This takes into account the rates on the state level county level city level and special level. - The Sales Tax Rate for Summit County is 78. With local taxes the total sales tax rate.

Information on Utah taxes for people who are relocating to the area. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales.

The state sales tax rate in Utah is 4850. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40.

4 State Sales tax is 485. The base state sales tax rate in Utah is 485. The assessors office also keeps track of ownership changes.

The US average is 46. The minimum combined 2022 sales tax rate for Summit County Ohio is. Any sale funds in excess of the total amount of delinquent taxes penalties interest and administrative fees will be treated as Unclaimed Property under Title 67 of the Utah Code Annotated and forwarded to the Utah State Treasurer after one year.

Summit County Sales Tax. The December 2020. The 2022 Summit County Tax Sale will be held online.

Washington County Sales Tax. The most populous zip code in Summit County Utah. Wasatch County Sales Tax.

The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value.

Utah Building Code Permit Place

Suspect Evades Police Enters Home Where Family Was Sleeping

Summit County Utah Republican Party

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Corporate Retention Recruitment Business Utah Gov

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Property Taxes When To Consider An Appeal Choose Park City Real Estate

Venues Summit County Summit County Ohio Map Ohio

Summit County Sales Tax Revenues Show Continued Economic Comeback In Wake Of Covid Parkrecord Com

News Flash Summit County Ut Civicengage

Usu Extension Summit County Home Facebook

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

How Healthy Is Summit County Utah Us News Healthiest Communities

Salt Lake County Woman Killed In A Summit County Hunting Accident